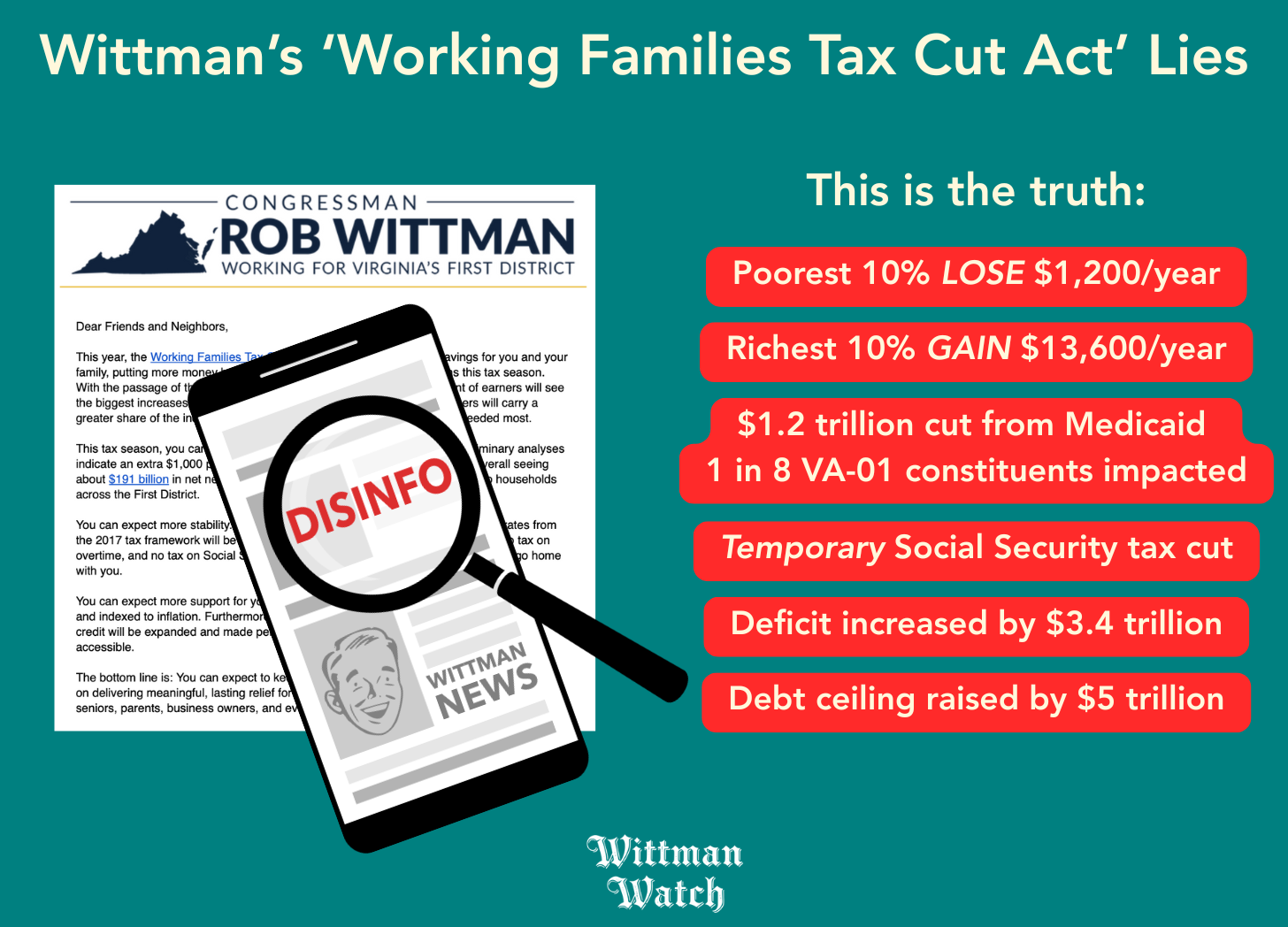

Wittman's “Tax Time” Disinformation Bomb

More deceit on H.R. 1 confirms Wittman is wrong for VA-01

On January 16, Rob Wittman sent an email: “What to expect this tax season.” It’s full of half-truths and outright deceptions, with a sprinkling of accuracies — Rob’s usual mix, with his normal goal of lulling low-information VA-01 voters into believing he’s succeeding on their behalf. He’s not, and we can prove it.

He makes a number of claims about the “Working Families Act” (a marketing name he and the Republican Propaganda Machine made up when the “One Big Beautiful Bill” was justifiably mocked as a terrible name), which is more accurately known as H.R. 1.

Wittman claims:

Most people will see income increases ❌

The top 20% will carry more tax burden ❌

Every eligible filer will get a $1,000 tax refund ❌

There’s $191 billion of net new tax relief nationwide ❌

“No tax on tips, no tax on overtime, and no tax on Social Security” ❌

2017 standard deduction increases and lower tax rates are made permanent

Child Tax Credit is boosted to $2,200 and indexed to inflation

Access to childcare tax relief and paid leave tax are expanded

And here’s his conclusion, verbatim:

“The bottom line is: You can expect to keep more of what you earn. In Congress, I’m focused on delivering meaningful, lasting relief for hardworking Americans — waitresses, welders, seniors, parents, business owners, and everyone striving to get ahead.”

There’s a lot to go through here, but let’s start with what’s true and accurate.

The standard deduction has doubled and is now permanent ✔️

Child Tax Credit (an under-used credit for employers) is indeed boosted to $2,200 ✔️

Childcare tax provisions are as stated ✔️

Aaaand, that’s it. Everything else is a half-truth or simply deceitful. Let’s explore these together!

The tax cut that gives your money to the wealthy

While H.R. 1 increases the standard deduction, and temporarily (and in a limited way) lowers taxes on tips, social security, and overtime, it also cuts $1.2 trillion from Medicaid and SNAP. Over 100,000 people in VA-01 rely on Medicaid; that’s 1 in 8 of us, including over 18,000 children. This means that what the government might give with one hand, it takes away and also steals your wallet with the other hand. But what does that mean in practice?

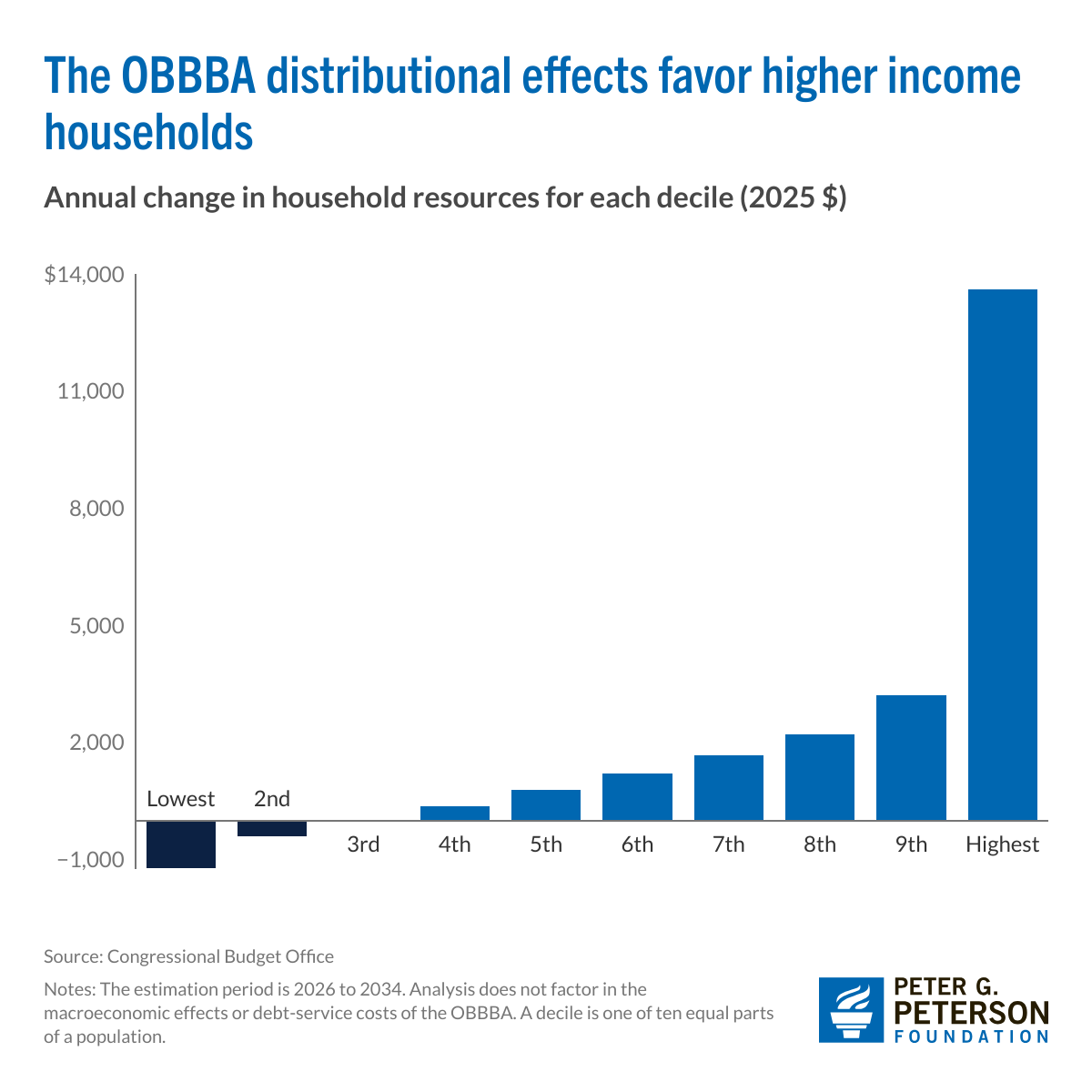

For a start, the claim that most of us will see income increases is far more complex than Wittman portrays. The Congressional Budget Office (CBO) says that:

Lowest-income families will lose $1,200/year on average (equivalent to 3.1% of their income)

Middle-income families will gain around $800-$1,200/year (but that’s not the whole story!)

The top 10% will get around $13,600/year on average

So 60% of the tax benefits of H.R. 1 flow to the top 25% of earners. Once we factor in the impact of tariffs, 90% of us — 90%! — will lose 7% of our income over the decade. Here’s what that looks like:

$40,000 income becomes $37,200

$80,000 income becomes $74,400

$120,000 income becomes $111,600

…and so on

A graph from the Peter G. Peterson Foundation shows the impact quite clearly:

The claim that the top 20% will carry more burden is technically accurate but deeply misleading, as it ignores the fact that they already pay 83.6% of federal taxes and that this law delivers the largest dollar gains to the wealthiest people.

But your healthcare? No, that’s taken away. Your affordable household goods? No, tariffs are destroying that. Your lower energy prices? No, we’re going to dig up old dinosaurs and burn them because that’s super efficient compared to free wind or solar, apparently. And so on.

That $1,000 refund is clerical, and never to be repeated

Many of us will get a refund of about $1,000 this year because the IRS didn’t update the tax tables, to make your refunds look good. Each year, the IRS is supposed to update the tax withholding tables — the numbers that tell employers how much to take out of our paychecks each pay period — so we don’t have a huge tax burden at the end of the year. They chose not to do that this year, so most of us have had too much withheld from our paychecks.

This means each of us has unwittingly given the government an interest-free loan all year. If you feel annoyed about that, good — you should be! And as we know, spending cuts will harm low-income households more than the tax cuts will benefit them. The tax tables will be updated for 2026, but the impact of tariffs and increased healthcare costs alone will wipe out any gains we may have had from the H.R. 1 tax cuts.

Wittman suggests we should be delighted to be getting $1,000 back. That’s only happening because of a clerical error (at best) or a scheme to withhold more money from us (at worst). Either way, this is not something he should crow about like a victory. He should instead be demanding the government pay us all interest on the loan we all provided.

Tips, overtime, and Social Security will be taxed again

We’ve covered most of this ground before:

“No tax on tips and overtime”: Only up to $25,000, and not for most middle class households. Also, it expires in 2028. Classic Republican ploy: temporary and deferred tax cut for regular people, permanent and immediate cuts for billionaires.

“Tax relief for seniors”: H.R.1 gives a $6,000 deduction for seniors (65+), which expires in 2028, and phases out starting at $75k (single filer) or $150k (joint) MAGI, up to $175k/250k. This is not “no tax on Social Security,” as Wittman claims. Further, the credit’s design means upper middle class seniors will get nothing at all (as the tax credit phases out for them), and less wealthy seniors only get a little for just three years. Then what? Again, temporary tax cuts for you, permanent gains for the ultra-wealthy (of any age) through the broader provisions of the new law.

Wittman’s most egregious misrepresentation is the phrase “no tax” on Social Security. As we just reviewed, that’s just flat-out wrong: Social Security is still taxed but there’s now a limited, temporary credit in play.

It’s what Wittman doesn’t say that is most damning

The most significant aspect of Wittman’s email is not what it says, but what it systematically omits, making the whole thing an exercise in disinformation. Let’s examine the cuts to benefits and the tax details that Wittman has chosen not to highlight for you because he knows you won’t like them.

Medicaid cuts devastate VA-01

The law cuts $1.2 trillion from Medicaid and SNAP over 10 years, including a 12% reduction in Medicaid spending and the addition of new work requirements. In Virginia’s First District:

100,900 residents rely on Medicaid (12.5% of the population)

18,300 children depend on Medicaid coverage

31,700 low-wage workers receive Medicaid

Major hospitals in the district derive 16-22% of revenue from Medicaid

Wittman’s email mentions none of these facts. He voted for legislation that will force many of us and our neighbors to lose health coverage entirely or face drastically higher premiums.

Tax benefits go to the wealthy while the poor lose money

As we wrote above, the lowest-income households will see their resources decline by 3.1% while the top 10% will see massive gains. The law is more regressive than any major legislation in decades. Wittman presents the opposite impression by citing a cherry-picked analysis.

Massive deficit and debt ceiling increases

The law explodes the budget deficit by $3.4 trillion over 10 years and raises the debt ceiling by $5 trillion. Wittman, who has historically positioned himself as fiscally conservative, makes no mention of this. Why? If he’s such a fiscal conservative, why is he failing to scream the House down about these generationally gigantic increases, and the burden he’s placing on Americans for generations to come? It’s simple hypocrisy and political gamesmanship, where we all lose while he and his friends steal our futures.

And he may be profiting himself, up to $59,300

Wittman himself stands to gain between $19,900 and $59,300 from tax provisions in legislation he voted for, according to analysis by the Institute on Taxation and Economic Policy (which Wittman disputes, naturally). His net worth is approximately $5.6 million, placing him in the richest 5% of Virginians who receive nearly half of the state’s tax cuts. His email doesn’t say anything about this, and his conflict of interest is not disclosed.

Temporary benefits for you, permanent for the top 10%

Wittman states provisions will be “made permanent” but fails to clarify that the popular provisions he highlights (tips, overtime, Social Security and senior deductions) are all temporary, expiring after 2028. Only provisions that primarily benefit higher earners (estate tax increases, pass-through deductions, corporate provisions) are permanent. Once again, the wealthy get permanent benefits while the rest of us get a token offering in the meantime.

Don’t let Wittman’s artificial sugar make you sick

Wittman’s email is a fine example of carefully crafted disinformation. Many of us in VA-01 care deeply about paying less tax, and Wittman’s message tries to speak directly to that concern. Wittman’s selective framing of the facts and omission of key information about the new law means his message is fundamentally dishonest — it is designed to mislead those of us who care about affordability, tax cuts, and the economy. The fact is, most of us will have less income and be less able to afford stuff because of H.R. 1. Even the name “Working Families Tax Cut Act” is designed to confuse matters. The law hugely benefits the wealthy by taking resources away from working families.

Stay focused. Understand and see through this disinformation campaign. Wittman isn’t working for us. He’s working for his donors and his party’s interests, and we must secure better representation in Congress for VA-01.