"Meaningful Wins"? OK, Mr. Grinch

Average Virginia household is worse off under Wittman/Trump

Rob Wittman claims that "meaningful wins" for #VA01 will show up in 2026. But the average VA household is significantly WORSE OFF because of the Trump regime's actions - tariffs, increased healthcare costs, lost jobs, and pitiful 1.7% GDP growth in VA wipe out any gains we may have gotten. Wittman is really the Grinch!

First, we know Wittman does very little actual work. 87 working days in Congress this year, in fact. (Would YOUR boss let you do that?!) His message portrays the results as big achievements. But they're just...not! Let's break it down.

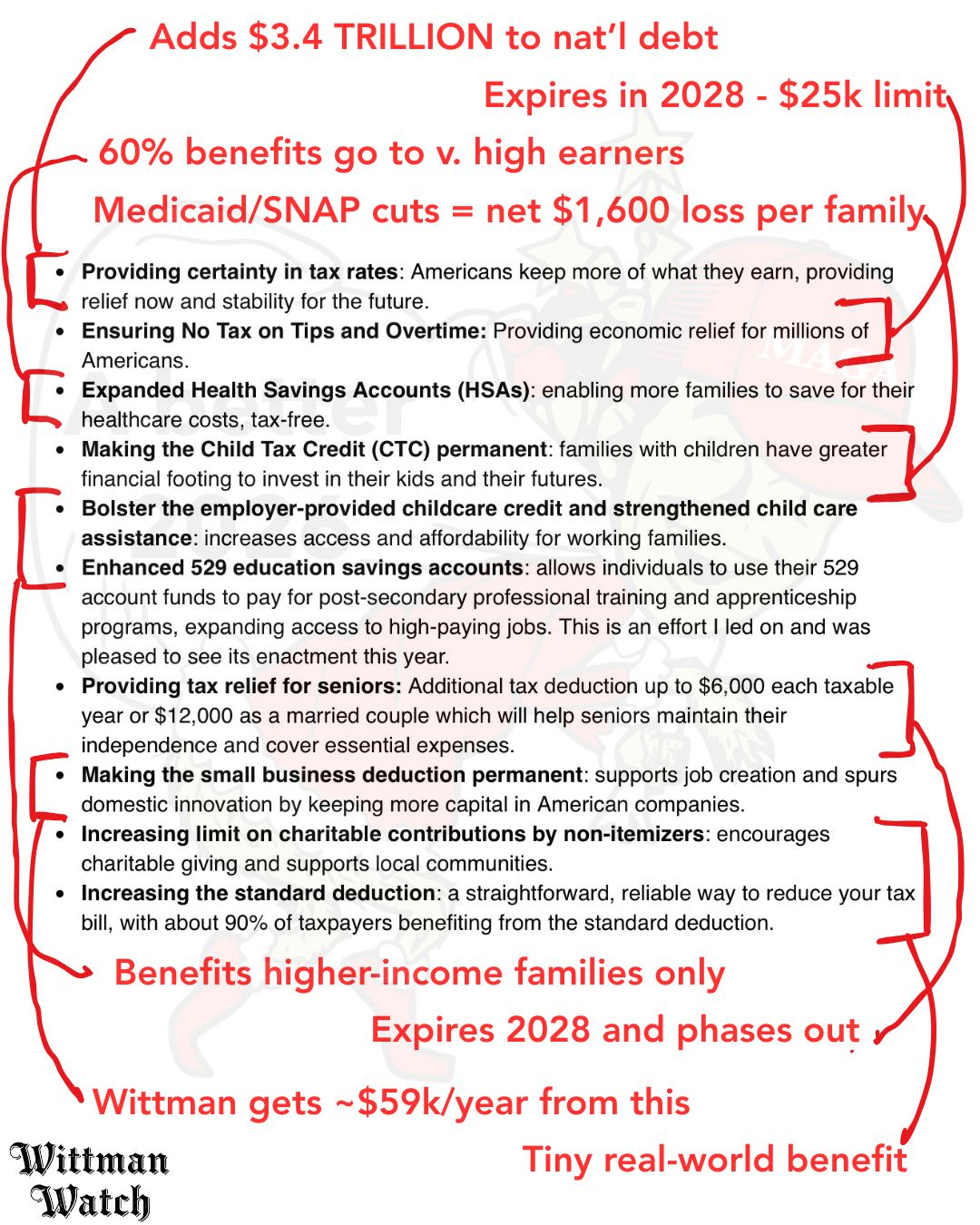

"Certainty in tax rates": Half of VA's tax cuts flow to the richest 5%, and adds $3.4 TRILLION to the national debt. This is massive, gigantic, never-before-seen fiscal IRRESPONSIBILITY. We will all pay eventually - except the billionaires.

"No tax on tips and overtime": Only up to $25k, and not for most middle class households. Also, it expires in 2028. Classic Republican ploy: temporary and deferred tax cut for regular people, permanent and immediate cuts for billionaires.

"Expanded HSAs": 60% of HSA tax benefits go to households earning $100,000+. So higher-income families get a break but lower income folks can't even afford healthcare of any kind. This makes zero sense as a policy for most Virginians!

"Child Tax Credit permanence": Lower-income families get no change to their situation, except one: they will have a net LOSS of $1,600 due to Medicaid and SNAP cuts. Higher-income households get $500. That's it.

"Bolster employee-provided childcare credit, child care assistance": A little change to an employer-focused tax credit (employees don't get anything), which is nothing compared to the $1 TRILLION in cuts to healthcare and food assistance that far more people need. Again, net negative impact on most Virginians.

"Enhanced 529 education savings accounts" (which Wittman led): Higher-income families benefit most from this, as they have disposable income to save. It's a long-term benefit for the affluent. ARE YOU SEEING THE TREND YET?

"Tax relief for seniors": $6k deduction for 65+ seniors expires in 2028, and phases out starting at $75k (single filer) or $150k (joint) MAGI, up to $175k/250k. Wealthier seniors get nothing. Less wealthy seniors get a little for just three years. Then what? Again, temporary tax cuts for you, permanent for the ultra-wealthy.

"Permanent small business deduction": This refers to the Section 199A pass-through business income deduction which mainly benefits wealthy business owners, not traditional small businesses. Example: Wittman will PERSONALLY save $19,900-$59,300 annually due to this. He's trying to fool you again!

"Charitable contribution limit increase for non-itemizers": Over 90% of taxpayers take the standard deduction. The increased limit provides minimal benefit compared to the bill's massive cost, and HR1's core feature: permanent tax cuts for high earners financed by program cuts affecting low-income Virginians and Americans nationwide.

"Increasing the standard deduction": The increase is modest ($750 for single filers, $1,500 for joint), so the absolute dollar benefit is tiny for middle-class families compared to the $12,000 average annual increase for top income households.

What does this all mean? Wittman's "meaningful wins" are anything but! The little sugar that Wittman/Trump sprinkles around is nowhere near as significant as the massive breaks they've handed to billionaires. Virginian households are, on average, far worse off today than they were in 2024, and 2026 is looking worse yet. And even the little bit of sugar largely expires in 2028.

Wittman has been the Grinch throughout 2025. Now he's conniving to fool you into thinking 2026 will be better - but he's done nothing to ensure that and everything to guarantee it can't happen. We're not fooled, Mr. Grinch!